Based on insights from Harvey Blom, Managing Partner at GRN Energy and his recent post on the topic. https://lnkd.in/p/eAC8ahqm

Executive Insights

The rapid growth of artificial intelligence and high-performance computing (HPC) is creating unprecedented demand for data center capacity, with Goldman Sachs projecting U.S. data center demand to reach 45 GW by 2030—more than double current levels. Traditional data centers, constrained by legacy infrastructure and multi-year development timelines, are struggling to meet this explosive demand.

Bitcoin mining facilities, often dismissed as single-purpose operations, represent an overlooked solution to this infrastructure gap. This article presents a new framework for understanding Bitcoin mining as “Tier 0” in the data center evolution—a strategic testing ground and risk mitigation tool for developing higher-tier AI and HPC infrastructure.

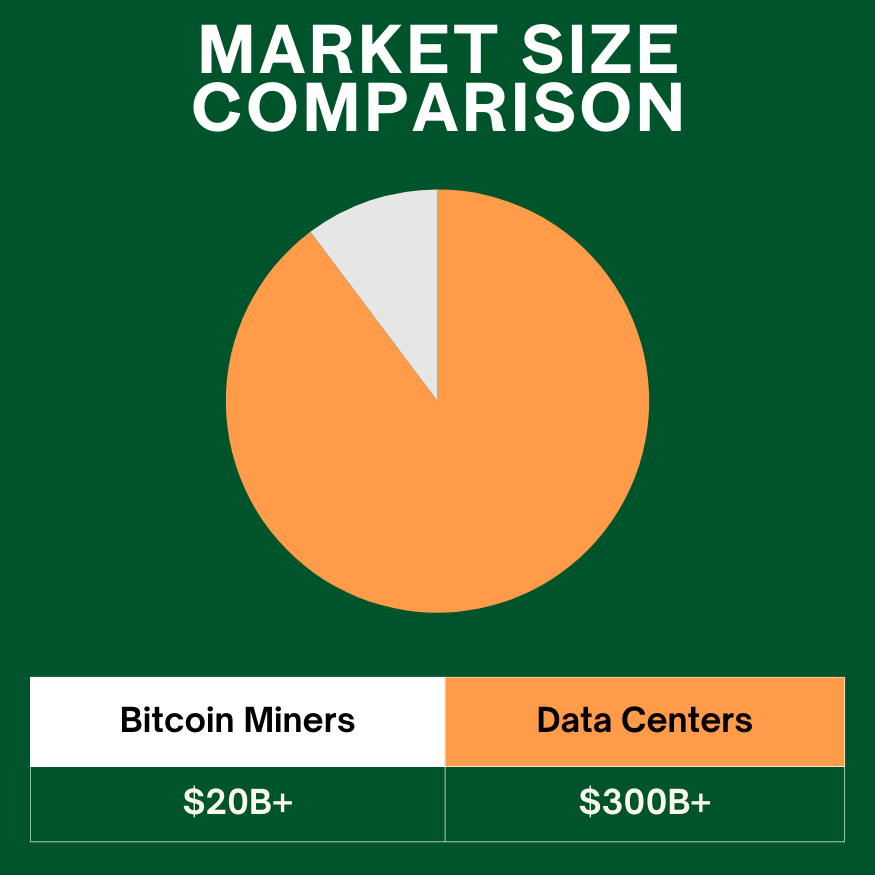

The $300+ Billion Opportunity

The data center market, valued at over $300 billion and accelerating, dwarfs the $20 billion Bitcoin mining industry. Yet this size differential obscures a critical insight: Bitcoin mining operations have already solved many of the infrastructure challenges that plague traditional data center development.

Smart companies are beginning to recognize that Bitcoin mining isn’t competing with data centers—it’s the first step in their evolution. As Harvey Blom of GRN Energy explains, “Bitcoin mining serves as a testing vehicle for data center development before you build Tier 3/4 infrastructure.”

Understanding the Tier System

The data center industry uses a tier classification system to denote levels of redundancy and reliability:

• Tier I: No redundancy

• Tier II: Redundancy

• Tier III: Concurrently maintainable

• Tier IV: Fault-tolerant

We propose adding Tier 0 to this framework, representing Bitcoin mining as the foundational layer that enables rapid infrastructure deployment and testing.

Why Bitcoin Mining Excels as Tier 0

Bitcoin mining operations possess several unique characteristics that make them ideal for initial infrastructure development:

1. Rapid Site Identification

Bitcoin miners have become experts at finding optimal locations with:

• Stable, affordable power access

• Favorable climate conditions for cooling

• Robust grid connectivity

• High-speed internet infrastructure

2. Infrastructure Stress Testing

Mining operations routinely:

• Test infrastructure at scale (100MW+ loads)

• Operate 24/7 at maximum capacity

• Identify and resolve bottleneck issues

• Prove site reliability under extreme conditions

3. Unmatched Flexibility

Unlike traditional data centers, Bitcoin mining offers:

• Instant shutdown capability when grid demands it

• Portable equipment that can be relocated if needed

• Immediate revenue generation during development phases

• Minimal downtime requirements

4. Financial De-risking

The economics are compelling:

• Start with $50M in Bitcoin infrastructure instead of $500M for Tier 4

• Generate cash flow while planning larger developments

• Relocate equipment if the site proves unsuitable

• Test market conditions with minimal commitment

The Phased Evolution Strategy

Leading developers are adopting a three-phase approach:

Phase 1: Deploy Bitcoin Mining (Tier 0)

• Immediate cash flow generation

• Prove location viability

• Establish operational expertise

• Build relationships with utilities

Phase 2: Add Edge Computing (Tier 1-2)

• Leverage existing infrastructure

• Gradually increase complexity

• Maintain mining operations alongside

• Test higher-density computing requirements

Phase 3: Build AI/HPC Facilities (Tier 3-4)

• Deploy with confidence based on proven site performance

• Utilize established power and cooling infrastructure

• Benefit from operational knowledge gained

• Complete transformation to high-tier data center

Critical Considerations

Not all Bitcoin mining locations are suitable for higher-tier development. As Blom notes in his disclaimer, “Each data center tier has its own unique requirements, and not all Bitcoin mining facilities are able to meet the higher-tier standards.”

Key factors for successful evolution include:

• Location suitability for long-term development

• Energy infrastructure capable of supporting higher tiers

• Cooling capacity for dense computing requirements

• Network connectivity for low-latency operations

• Physical security and redundancy capabilities

The Strategic Advantage

Bitcoin mining offers a unique value proposition during the typical 3-5 year construction timeline for higher-tier data centers. As Blom explains, “If the energy infrastructure is already in place, it makes sense to mine Bitcoin during that interim period—or later, to utilize redundant power capacity that would otherwise go unused.”

This approach transforms Bitcoin mining from a standalone business into a strategic tool for:

• Risk mitigation in site selection

• Revenue generation during development

• Infrastructure validation before major investment

• Operational expertise building

Market Implications

The convergence of Bitcoin mining and traditional data center development has significant implications:

For Energy Companies

• New revenue streams from stranded assets

• Proof of concept for larger developments

• Grid stabilization through flexible loads

• Accelerated infrastructure deployment

For Data Center Developers

• Reduced development risk

• Faster time to market

• Proven site performance metrics

• Established utility relationships

For Investors

• De-risked infrastructure investments

• Multiple exit strategies

• Immediate cash flow potential

• Exposure to both crypto and AI markets

Looking Forward

The data center industry is at an inflection point. With AI and HPC demand outstripping supply, innovative approaches to infrastructure development are essential. Bitcoin mining as Tier 0 represents more than a temporary solution—it’s a fundamental rethinking of how we approach data center development.

As traditional energy executives begin to understand this model, we expect to see accelerated adoption of the Tier 0 approach. The companies that recognize this opportunity early will be best positioned to capture value in both the immediate term through mining operations and the long term through strategic infrastructure development.

Conclusion

The narrative around Bitcoin mining is evolving from energy-intensive cryptocurrency generation to strategic infrastructure development. By reframing Bitcoin mining as Tier 0 in the data center evolution, we unlock new pathways for meeting the explosive demand for AI and HPC infrastructure.

This isn’t about choosing between Bitcoin mining and data centers—it’s about recognizing that one can strategically enable the other. As the industry continues to mature, expect to see more sophisticated approaches to infrastructure development that leverage the unique advantages of Bitcoin mining as a foundation for the data centers of tomorrow.

For companies with the right locations, expertise, and vision, Bitcoin mining represents not just a business opportunity, but a strategic bridge to the AI-powered future. No crypto ideology required—just infrastructure intelligence.

About the Author: This article is based on insights from Harvey Blom, Partner at GRN Energy, who specializes in the intersection of Bitcoin mining, renewable energy, and data center development. The views expressed represent a synthesis of industry trends and strategic frameworks for infrastructure development.

#HPC #ArtificialIntelligence #DataCenterDesign #CryptoMining #RenewableEnergy #InfrastructureInvestment #BitcoinStrategy #GridModernization #TechInvestment #EnergyManagement #DigitalTransformation #MiningEvolution #AICompute #PowerInfrastructure #SustainableMining